How Interest Rates Affect the Stock Market

Let’s discuss the basics of the relationship between interest rates and the stock market. When the interest rate is high, the cost of borrowing money from the bank is also high. This makes traders less interested in getting loans because they have to pay higher interest rates.

When interest rates drop, businesses are more likely to seek loans. This is because the cost of borrowing becomes lower, and they can expand their businesses with higher investments. The increase in investment leads to business growth, capital expansion, and higher returns. Businesses may also invest in machinery and equipment to boost productivity.

The fundamental relationship is that when interest rates are low, the opportunities for profit in the stock market increase. Fund managers and investors are more likely to allocate more funds to the stock market because companies are expected to achieve higher profits due to increased investment.

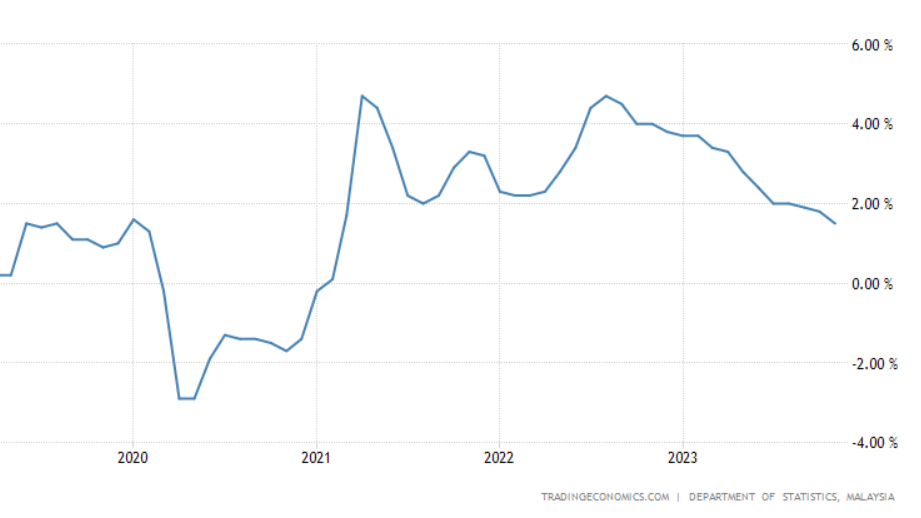

Let’s look at the evidence in stock market data. In early 2020, during the economic crisis caused by the pandemic, the Federal Reserve lowered interest rates. At the same time, the Dow Jones index fell. This demonstrates a clear relationship between the decrease in interest rates and the decline in the stock market.

When the Federal Reserve raised interest rates again in 2022, the Dow Jones index also showed a decline. However, from late 2022 to 2024, as investors believed that interest rates might not rise higher, the stock market began to recover and rise.

In conclusion, the relationship between interest rates and the stock market is complex but understandable. Low-interest rates tend to stimulate investment and economic growth, while high-interest rates can lead to a decline in the stock market. This is something investors need to monitor to make informed decisions in the stock market.